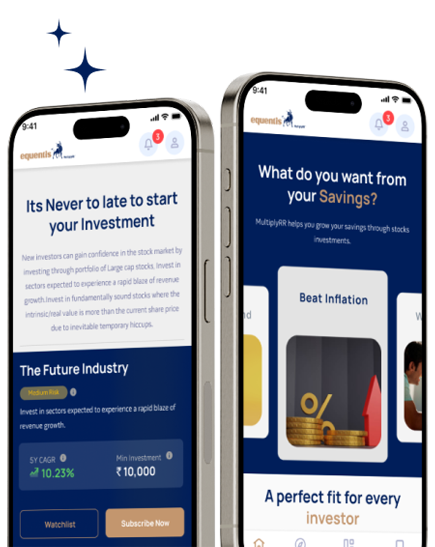

10 lac+ Registered Users

20+ Years of Investment Expertise

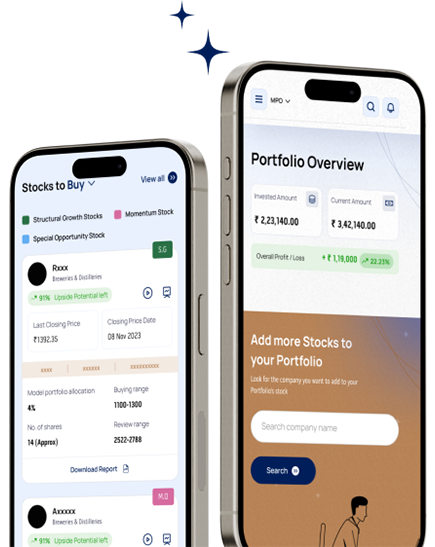

Algorithm Backed

Our businesses

Founder & Managing Director

Mr Manish Goel is the visionary Founder and Director of Equentis Wealth Advisory Ltd., an equity advisory firm dedicated to transforming the landscape of financial literacy and wealth creation in India.

A qualified Company Secretary, Law Graduate, and Master of International Trade and Finance from the UK, Manish has carved a niche as a trusted advisor and thought leader in the industry. With his fervent passion for the financial markets and relentless commitment to empowering investors, he has carved a niche as a thought leader in the industry.

Having honed his expertise as a Finance Director across Europe and the UK, Manish identified a profound gap in financial literacy and investment opportunities upon returning to India. Driven by the belief that wealth creation through the stock market should not be the privilege of a select few but a democratic right accessible to all, he embarked on a mission to bridge this gap by setting up Equentis in 2009.

Under his leadership, Equentis Wealth Advisory Ltd. has emerged as a beacon of hope for countless investors, providing them with the knowledge, tools, and strategies needed to navigate the complexities of the financial markets. His unwavering perseverance and dedication to fostering financial inclusion have been instrumental in transforming the lives of many, helping them achieve their financial goals and secure their futures.

Meet our leaders

Board members & management team

Our value system

The foundation of our success

Equal existence

We believe wealth creation must be everyone's right, ensuring that it is not a privilege limited to a few but a possibility for every individual.

Innovation

We believe in moving ahead of time, so we’ve built an in-house Quant Engine using 300+ Smart Algorithms that help us arrive at the right stock recommendations for our customers.

Humility

We believe in becoming better each day. We value the feedback from our precious customers, competitors, and the market to evolve.

Honesty

We prioritize transparency, integrity, and truthfulness in all our interactions with customers, stakeholders, and the public.

Thinking big

We dream beyond the conventional, and embrace innovation and change.

Collaboration

Our customer’s success is our success! We recognize the value of working with others to achieve common objectives, enhance capabilities, and create mutually beneficial outcomes.

Impact

We aspire to make a difference in the industry and investor community, becoming a driving force for positive change.

Integrity

We are dedicated to always being honest, transparent, and ethical in everything we do

Our philosophy

There's only one way to create wealth - LONG TERM.

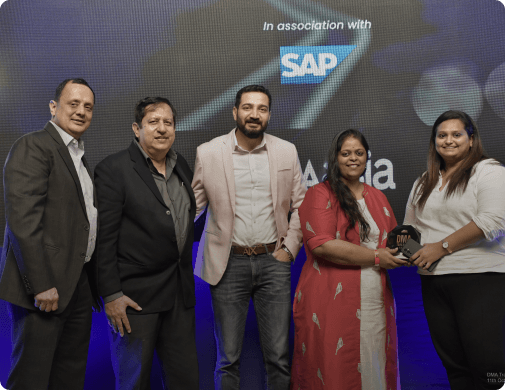

Awards & recognition

Winning moments and award-worthy highlights

Clients speak

Our subscribers love us!